triple bottom stock screener

Superior UI UX ie. These levels act as a resistance level.

Triple Bottom Stock Pattern Easy To Understand Guide

Vwap-- 15min-- sell - Vwap-- 15min-- sell.

. How To Use Triple Bottom Screener. Akropolis is forming a descending triangle on the 4hr time frame with a triple bottom on strong support. Superior UI UX ie.

Advertisement free surfing 2. Day working 1 - Day working 1. No Records for Triple Bottom Screener found.

Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. Features of using Chart Pattern Screener in MyTSR. Single Page Application for faster download time Quick Sorting Filtering Export data.

Superior UI UX ie. The view below shows two results as of this writing that meets all this criteria 3 descriptive I have selected. Features of using Chart Pattern Screener in MyTSR.

This is a stock market Screener for NSE. Triple Bottoms The Triple Bottom pattern appears when there are three distinct low points 1 3 5 that represent a consistent support level. Features of using Chart Pattern Screener in MyTSR.

Filter Patterns on a pre-created stock basket like NSE 500 Midcap smallcap. Advertisement free surfing 2. PNFatr 1214 Triple Bottom Back to Point Figure Stock Screener Point n Figure PnF Charts - Technical Analysis from A to Z Point Figure PF charts differ from traditional price charts in that they completely disregard the passage of time and only display changes in prices.

Failure to again cross them for the 4rd time could result in some downside. The easiest screener to identify Triple bottom Patten is on Finviz. Filter Patterns on a pre-created stock basket like NSE 500 Midcap smallcap.

Triple BottomPattern Screener for Indian Stocks from 5 Mins to Monthly Ticks. Overview Charts Fundamental Technical Price Performance Financial Ratios Relative Strength Financial Strength Dividend Timestamp Membership Details. Filter Patterns on a pre-created stock basket like NSE 500 Midcap smallcap.

Single Page Application for faster download time Quick Sorting Filtering Export data. For example filter Bullish Engulfing on. Single Page Application for faster download time Quick Sorting Filtering Export data.

Stocks hitting triple bottom in daily candle with increasing volume and cost Technical Fundamental stock screener scan stocks based on rsi pe macd breakouts divergence growth book vlaue market cap dividend yield etc. Without trend reversal filterfor 300 peroidfor given profit - Stocks nearing 200 day high by 5 showing consolidation for the past 30 days with volume above 50 day average. The security tests the support level over time but eventually breaks resistance and makes a strong move to the upside.

Generated at Generate at End of Business Day EOD null. Triple Bottom Stock Screener Criteria. Single Page Application for faster download time Quick Sorting Filtering Export data.

Superior UI UX ie. Superior UI UX ie. All Patterns Screener Learn Triple Bottom.

The formation shows the 3 major highs of the stock over a period from where it previously saw selling pressure. Filter Patterns on a pre-created stock basket like NSE 500 Midcap smallcap. For example filter Bullish Engulfing on.

Features of using Chart Pattern Screener in MyTSR. Stoch rsi sell -. This is a stock market Screener for NSE.

Set alert and buy the breakout of the upper trend line. The share market Screener of NSE will analyse the selected data for all listed stocks of NSE to find the sstocks that are forming the pattern selected by you. For example filter Bullish Engulfing on.

Be careful of the bearish divergence on the RSI and the bearish cross on the Stochastic RSI. If you just want to filter for triple bottom pattern stocks go to technical and under the pattern drop down select Multiple bottom. Features of using Chart Pattern Screener in MyTSR.

Features of using Chart Pattern Screener in MyTSR. Superior UI UX ie. Screener - Triple Bottom Chart Patterns on Daily Tick in Short Term Medium Term Long Term Futures Option Stocks More about Triple Bottom Pattern Generated at Generate at End of Business Day EOD null Features of using Chart Pattern Screener in MyTSR 1.

Select data to use select what to screen and click Screener button. Triple Top offers one of the bets methods to have a look at the major resistance level for a stock. Superior UI UX ie.

Back to Traditional Patterns Stock Screener. Single Page Application for faster download time Quick Sorting Filtering Export data. 15 min cansolidation by vansh -.

Filter Patterns on a pre-created stock basket like NSE 500 Midcap smallcap. Superior UI UX ie. AKRO 4hr triple bottom idea.

Single Page Application for faster download time Quick Sorting Filtering Export data. For example filter Bullish Engulfing on. Screener - Triple Bottom Chart Patterns on Daily Tick in Long Term Short Term Medium Term Futures Option Stocks More about Triple Bottom Pattern Generated at Generate at End of Business Day EOD null Features of using Chart Pattern Screener in MyTSR 1.

For example filter Bullish Engulfing on. Select data to use select what to screen and click Screener button. NSE Daily chart Screener.

Money flow is increasing on a larger time frame.

Triple Bottom Reversal Chartschool

What Are Triple Bottom Stock Patterns And How Do You Trade Them

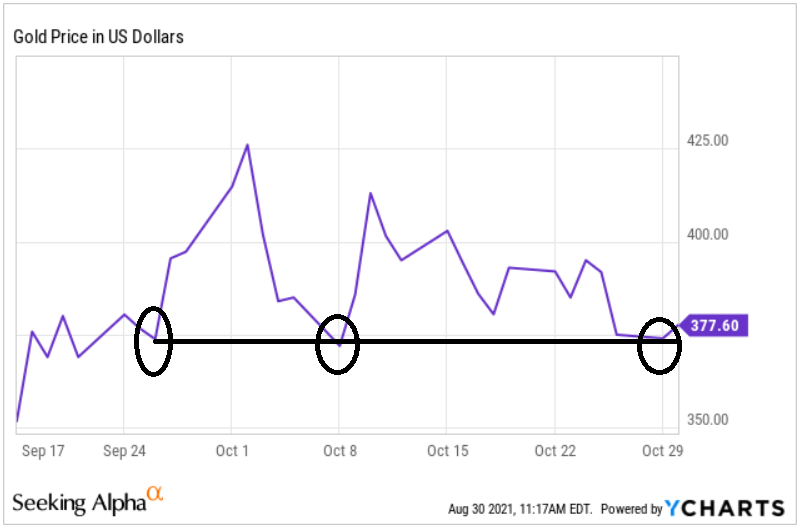

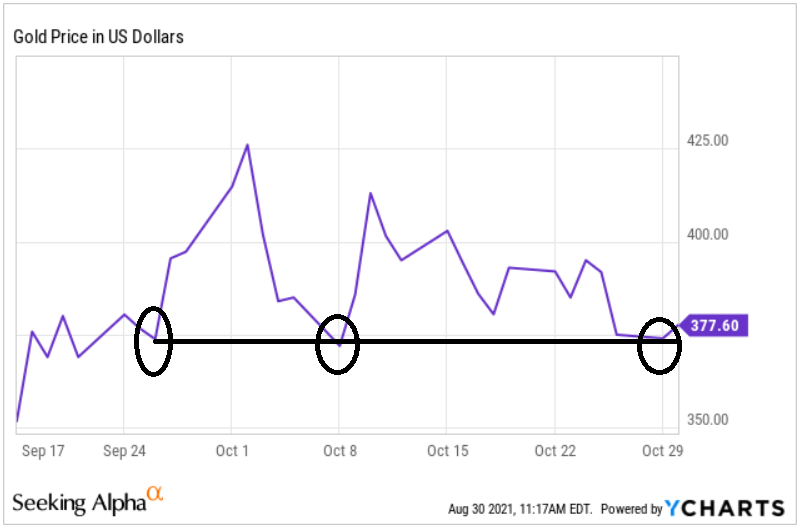

A Short History Of Triple Bottoms In Gold Seeking Alpha

Triple Bottom Reversal Chartschool

Triple Bottom Chart Pattern Example 2

Tutorials On Triple Bottom Chart Pattern

Triple Bottom Stock Pattern Easy To Understand Guide

Screener Triple Bottom Chart Patterns On Daily Tick In Short Term

Screener Triple Bottom Chart Patterns On Daily Tick In Short Term

Chart Pattern Triple Top Tradingview

Chart Pattern Screener Triple Bottom From 5 Mins To Monthly Ticks

Bitcoin Triple Bottom Formation And Breakout For Bitfinex Btcusd By Miningservant Tradingview

What Are Triple Bottom Stock Patterns And How Do You Trade Them